Payroll tax calculator 2020

It will confirm the deductions you include on your. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Calculation Of Federal Employment Taxes Payroll Services

Request Your Demo Today.

. Federal Salary Paycheck Calculator. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. All inclusive payroll processing services for small businesses.

A 2020 or later W4 is required for all new employees. See how your refund take-home pay or tax due are affected by withholding amount. Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management.

States dont impose their own income tax for tax year 2022. You can use the calculator to compare your salaries between 2017 and 2022. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Thats where our paycheck calculator comes in. Plug in the amount of money youd like to take home.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Use Before 2020 if you are not sure. How It Works.

Ad Compare This Years Top 5 Free Payroll Software. 3 Months Free Trial. Median household income in 2020 was 67340.

For example if an employee earns 1500 per week the individuals annual. See it In Action. Get a free quote today.

It can also be used to help fill steps 3 and 4 of a W-4 form. Ad Payroll So Easy You Can Set It Up Run It Yourself. Free Unbiased Reviews Top Picks.

Free salary hourly and more paycheck calculators. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. Get Started With ADP Payroll.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. The maximum an employee will pay in 2022 is 911400.

Get a free quote today. Discover ADP Payroll Benefits Insurance Time Talent HR More. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ad Process Payroll Faster Easier With ADP Payroll. All Services Backed by Tax Guarantee.

Starting as Low as 6Month. Your employer withholds a 62 Social Security tax and a. Get Started With ADP Payroll.

The payroll tax rate reverted to 545 on 1 July 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Estimate your federal income tax withholding. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Ad Reduce Risk Drive Efficiency.

Ad Process Payroll Faster Easier With ADP Payroll. The calculator is updated with the tax rates of all Canadian provinces and. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

For help with your withholding you may use the Tax Withholding Estimator. Ad Accurate Payroll With Personalized Customer Service. Small Business Low-Priced Payroll Service.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The IRS has changed the withholding rules effective January 2020. Use this tool to.

The information you give your employer on Form W4. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. You can use the Tax Withholding.

How To Calculate Income Tax In Excel

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

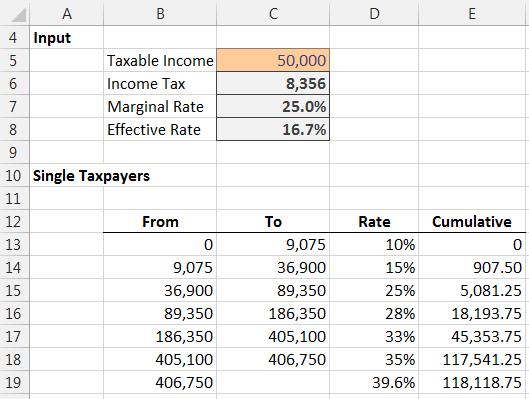

How Is Taxable Income Calculated How To Calculate Tax Liability

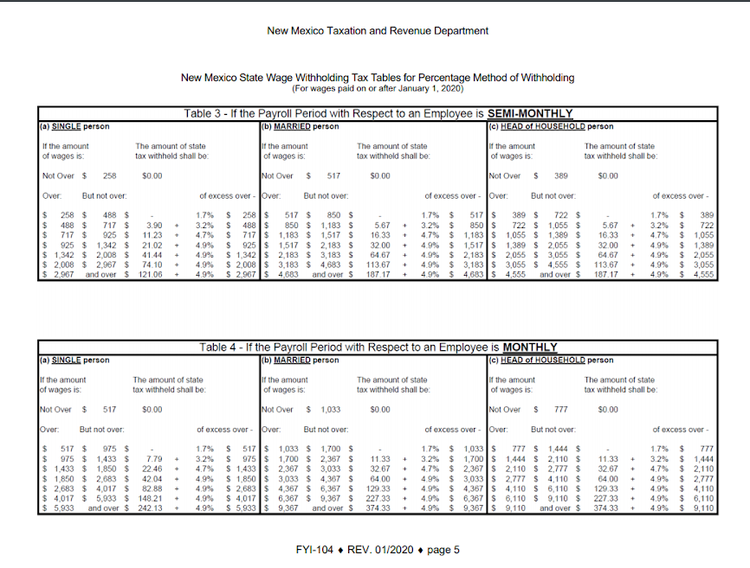

How To Calculate Payroll Taxes Methods Examples More

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Income Tax Formula Excel University

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes For Your Small Business

Tax Withholding For Pensions And Social Security Sensible Money

Tax Rate Calculator Flash Sales 54 Off Www Ingeniovirtual Com

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More